All Categories

Featured

Table of Contents

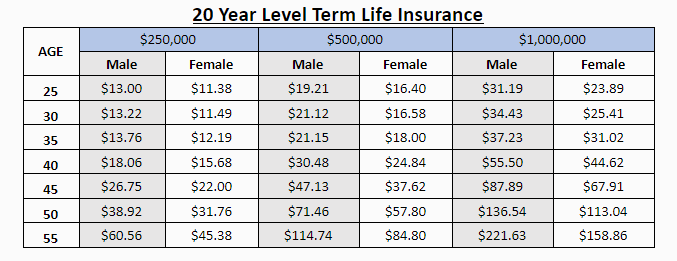

A degree term life insurance policy policy can provide you satisfaction that the people that depend upon you will have a survivor benefit throughout the years that you are intending to support them. It's a way to assist care for them in the future, today. A degree term life insurance policy (often called level costs term life insurance policy) policy supplies protection for a set number of years (e.g., 10 or two decades) while maintaining the premium settlements the exact same throughout of the policy.

With degree term insurance coverage, the cost of the insurance will stay the same (or potentially lower if dividends are paid) over the term of your policy, typically 10 or two decades. Unlike irreversible life insurance policy, which never ever expires as long as you pay premiums, a level term life insurance policy plan will certainly finish at some time in the future, generally at the end of the period of your level term.

What is Increasing Term Life Insurance? Comprehensive Guide

Due to this, many individuals utilize irreversible insurance as a secure financial planning device that can offer numerous needs. You might have the ability to transform some, or all, of your term insurance policy during a collection duration, usually the first one decade of your policy, without requiring to re-qualify for protection also if your health has altered.

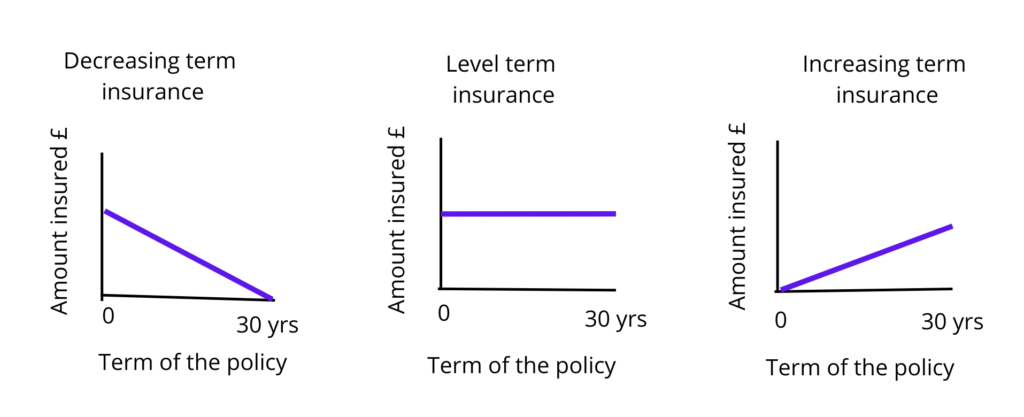

As it does, you might wish to include in your insurance coverage in the future. When you first get insurance policy, you may have little cost savings and a large mortgage. At some point, your financial savings will certainly expand and your home mortgage will certainly reduce. As this occurs, you might want to ultimately minimize your survivor benefit or consider transforming your term insurance to a permanent plan.

Long as you pay your premiums, you can rest easy knowing that your liked ones will certainly obtain a fatality advantage if you die during the term. Lots of term policies permit you the ability to convert to long-term insurance policy without having to take an additional health and wellness examination. This can enable you to benefit from the added advantages of a long-term plan.

Level term life insurance policy is one of the easiest courses right into life insurance policy, we'll discuss the advantages and disadvantages to ensure that you can select a plan to fit your requirements. Level term life insurance is one of the most common and basic kind of term life. When you're looking for temporary life insurance policy strategies, level term life insurance policy is one path that you can go.

You'll fill out an application that includes general personal info such as your name, age, etc as well as a much more in-depth set of questions regarding your clinical history.

The short answer is no. A level term life insurance policy plan does not develop money worth. If you're seeking to have a policy that you're able to withdraw or borrow from, you might check out irreversible life insurance coverage. Entire life insurance policy policies, as an example, allow you have the comfort of survivor benefit and can accumulate cash value with time, indicating you'll have extra control over your advantages while you're active.

What is Term Life Insurance With Accelerated Death Benefit? A Simple Explanation?

Motorcyclists are optional provisions included to your plan that can give you added advantages and defenses. Bikers are an excellent means to add safeguards to your plan. Anything can happen over the training course of your life insurance coverage term, and you intend to be prepared for anything. By paying simply a bit extra a month, bikers can supply the assistance you need in case of an emergency.

There are instances where these benefits are built into your policy, but they can additionally be offered as a different addition that requires added repayment.

Latest Posts

Loan Payment Protection Insurance

Mortgage Insurance In Case Of Death Or Disability

Long-Term Voluntary Term Life Insurance